Bitcoin’s price movements have created a frenzy in the fintechzoom.com crypto world as it surges past the $75,000 USD mark. With Bitcoin’s market cap exceeding $1.2 trillion and institutional adoption accelerating, we’re witnessing a historic moment in cryptocurrency evolution. The price of Bitcoin is constantly changing, therefore the importance of a reliable and accurate tracking tool for digital currencies cannot be overstated.

As we analyze the fintechzoom.com crypto market, it’s clear that Bitcoin manages the rest of the market, representing almost half of the total crypto market capitalization that increased from $1.5 billion to $2.5 billion. Indeed, Bitcoin has become a significant part of global finance and is now associated with ETFs, stocks, portfolios, and even pension funds. Through fintechzoom.com markets, investors can access real-time analysis that helps retail investors outperform institutional traders. When checking the fintechzoom.com bitcoin price today, we’re not just looking at numbers but tracking a financial revolution that continues to reshape our understanding of value and investment.

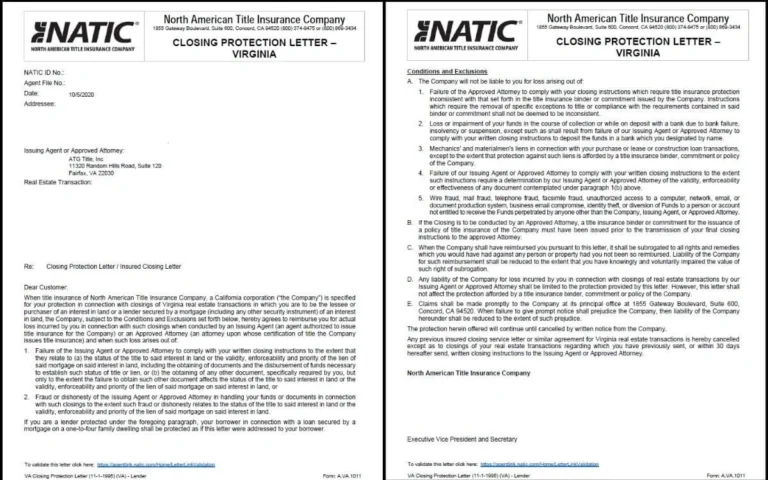

Bitcoin Surges Past $75,000: What Triggered the Rally?

Image Source: InvestingHaven

Bitcoin Surges Past $75,000: What Triggered the Rally?

On Wednesday morning, Bitcoin reached a new all-time high at just over $75,000 USD on Binance, gaining over 10% within 24 hours. This remarkable milestone has sparked widespread analysis across fintechzoom.com crypto market platforms about the underlying catalysts.

Institutional buying and ETF inflows

Spot Bitcoin ETFs have emerged as a dominant force driving the rally, recording $642.35 million in net inflows in a single day as part of five straight days of gains. Fidelity’s FBTC led with $315.18 million in fresh capital, while BlackRock’s IBIT followed closely with $264.71 million. Notably, cumulative net inflows have reached an impressive $56.83 billion, with total net assets standing at $153.18 billion—approximately 6.62% of Bitcoin’s total market capitalization. According to fintechzoom.com markets data, this institutional accumulation has significantly tightened Bitcoin’s supply dynamics.

Macroeconomic factors and inflation hedging

Several macroeconomic developments have simultaneously fueled Bitcoin’s ascent. The latest U.S. inflation data, showing a slight uptick in CPI to 2.7% in November, ignited optimism among cryptocurrency investors. Additionally, research indicates Bitcoin returns increase following positive inflation shocks, although studies suggest its effectiveness as an inflation hedge appears context-specific rather than universal.

Furthermore, Donald Trump’s victory in the U.S. presidential election provided substantial momentum, with Bitcoin jumping nearly 8% in early trading after the results. Market analysts attributed this surge to expectations of more crypto-friendly policies under a Trump administration.

Retail investor sentiment and social media buzz

Social media platforms continue to shape fintechzoom.com bitcoin price movements through sentiment and engagement. Research confirms Twitter sentiment can predict price returns of cryptocurrencies, with a positive correlation between investor attention to narratives and cryptocurrency returns. Bitcoin’s recent rebound sparked a notable increase in retail FOMO (Fear of Missing Out), marking the second largest spike in two weeks.

Nevertheless, despite the fintechzoom.com bitcoin price today reaching record highs, Google searches for “Bitcoin” only increased by 8%, suggesting retail participation remains subdued compared to previous bull markets. This dynamic creates an interesting contrast where institutional capital drives prices while retail sentiment plays a supporting role in the current rally.

How FintechZoom.com Tracks Bitcoin in Real Time

Image Source: keyring pro

How FintechZoom.com Tracks Bitcoin in Real Time

FintechZoom stands out as a comprehensive platform for monitoring cryptocurrency movements across volatile markets. As Bitcoin prices fluctuate by the minute, investors require reliable tools to make informed decisions.

FintechZoom.com Bitcoin price today: How it’s calculated

FintechZoom employs advanced data analytics and machine learning algorithms to deliver institutional-quality market data accessible to retail investors. The platform aggregates Bitcoin prices from multiple exchanges, minimizing inaccuracies from any single source. This multi-source approach ensures greater reliability, especially during periods of high market volatility.

The service updates Bitcoin values continuously, making it possible for traders to react quickly when rates shift. However, it’s worth noting that FintechZoom’s data may occasionally lag behind professional trading platforms by a minute or two.

Live charts, alerts, and sentiment tools

FintechZoom offers interactive charts that visualize Bitcoin’s price movements across various timeframes. Users can apply technical indicators such as RSI or Moving Averages to identify potential trends. This visual representation helps both novice and experienced traders understand complex market patterns.

One particularly useful feature is the customizable alert system. Traders can set notifications for specific price thresholds, ensuring they never miss important market movements. These alerts help users respond faster to sudden changes without constantly monitoring the platform.

Beyond price data, FintechZoom collects feedback from social media and headlines to measure market sentiment. This sentiment analysis provides valuable context about whether prices may rise or fall based on public perception.

Comparison with other crypto tracking platforms

| Feature | FintechZoom | CoinMarketCap | TradingView |

| Data Reliability | Medium | Very High | High |

| Update Frequency | Real-time | Real-time | Real-time |

| Analysis Depth | Basic with predictive analytics | Extensive historical data | Advanced technical analysis |

| Best For | Quick checks, casual tracking | Market research | Advanced traders |

In essence, FintechZoom balances accessibility with functionality, making it particularly suitable for those seeking straightforward market insights without overwhelming complexity.

What This Means for the FintechZoom.com Crypto Market

Image Source: Bitcoinist.com

What This Means for the FintechZoom.com Crypto Market

The surge past $75,000 has sent ripples throughout the entire cryptocurrency ecosystem, creating significant market dynamics that FintechZoom.com crypto analysts are monitoring closely.

Impact on altcoins and FintechZoom.com crypto prices

As Bitcoin establishes new price territories, altcoins face mixed fortunes. Ethereum declined 20%, currently trading around $1,466. Moreover, other major cryptocurrencies experienced substantial drops – Solana fell 60%, Cardano declined 55%, and Dogecoin plummeted 75%. FintechZoom.com crypto prices show these corrections occurred despite earlier predictions that coins like Dogecoin would break above $1.00.

Correlation with traditional markets like S&P 500 and gold

The relationship between Bitcoin and conventional assets has evolved substantially. Bitcoin currently exhibits a +0.49 correlation with high-yield corporate bonds and +0.52 with tech stocks. Conversely, it maintains a -0.29 correlation with the U.S. dollar. Since 2020, Bitcoin’s correlation with major equity indices jumped to approximately 0.5, though this correlation typically strengthens during market stress periods.

Market cap shifts and trading volume spikes

Recent trading volume data reveals telling patterns. Santiment identified two massive volume spikes coinciding with pivotal market moments – $84.08 billion during April’s tariff-driven dip and $90.90 billion when Bitcoin reached $124,000. Currently, trading volume remains elevated at $66 billion. These spikes often precede major price swings, offering valuable signals for FintechZoom.com markets users tracking potential entry and exit points.

How Investors Are Responding to the $75K Milestone

How Investors Are Responding to the $75K Milestone

Investors across the financial spectrum are adjusting strategies as Bitcoin crosses the $75,000 threshold, creating waves throughout investment portfolios.

FintechZoom.com Bitcoin ETF and stock exposure

Crypto-related stocks surged as Bitcoin approached its record high, with MicroStrategy gaining nearly 3% and Coinbase rising more than 3% in premarket trading. Clearly, the executive order signed by President Trump allowing crypto investments in 401(k) retirement plans provided additional momentum. Nonetheless, ETF flows show mixed sentiment, with one day recording total outflows of $541.10 million, even as BlackRock’s IBIT bucked the trend with $38.30 million in inflows.

Mining profitability and hash rate trends

Following the halving, Bitcoin’s supply issuance dropped from 6.25 BTC to 3.125 per block. Subsequently, hashprice declined dramatically to historically low levels, falling below $55.00/PH/Day. The network hashrate initially reached an all-time high of 654 EH/s before decreasing 10.9% post-halving, signaling potential miner capitulation.

Portfolio rebalancing and risk management strategies

Investors primarily utilize two rebalancing approaches: periodic (time-based) and threshold-based strategies. Research indicates a 15% threshold represents the statistical sweet spot for crypto portfolios. This approach enforces disciplined “buy low, sell high” practices while maintaining steady risk levels. In fact, proper rebalancing can potentially increase returns by capturing gains from market volatility.

Expert opinions on whether to buy, hold, or sell

Analyst forecasts remain divided. Long-term projections suggest Bitcoin could reach between $125K-$200K in 2025. Conversely, critic Peter Schiff warns of a potential drop to $75K, urging investors to “sell now and buy back lower”. Technical analysis indicates if Bitcoin breaks above $76K, over $525 million in shorts will be liquidated, potentially fueling further price increases.

Conclusion

Bitcoin’s historic surge beyond the $75,000 mark represents a significant milestone for cryptocurrency investors worldwide. Throughout this market evolution, we’ve witnessed substantial institutional adoption driving this rally, particularly through spot Bitcoin ETFs that have accumulated over $56 billion in net inflows. Additionally, macroeconomic factors including inflation concerns and political developments have further accelerated Bitcoin’s remarkable ascent.

Undoubtedly, platforms like FintechZoom have become essential tools for navigating this volatile landscape, offering real-time tracking capabilities that allow investors to make informed decisions. The platform’s multi-source approach ensures reliability during market fluctuations, while its interactive charts and alert systems provide valuable insights for both novice and experienced traders.

Nevertheless, this price surge has created ripple effects across the entire cryptocurrency ecosystem. Despite Bitcoin’s impressive performance, many altcoins have experienced significant corrections, highlighting the complex relationships within digital asset markets. At the same time, Bitcoin’s evolving correlation with traditional assets like equities and bonds demonstrates its increasing integration into mainstream financial systems.

As a result, investors are adapting their strategies accordingly. Crypto-related stocks have surged alongside Bitcoin, while mining economics continue adjusting to post-halving realities. Above all, portfolio rebalancing has emerged as a critical strategy for managing risk in this dynamic environment.

Therefore, as Bitcoin continues breaking new ground beyond the $75,000 threshold, we find ourselves at a pivotal moment in cryptocurrency history. While expert opinions remain divided about future price movements, one thing remains clear – Bitcoin has firmly established itself as a transformative force in global finance, fundamentally changing how we perceive value, investment, and monetary systems in the digital age.