In the complex world of real estate transactions, risk management is paramount. An Insured Closing Letter (CPL), also known as a Closing Protection Letter, is a critical but often misunderstood document that safeguards the financial interests of lenders and borrowers. If you’ve ever wondered who is responsible if a closing agent commits fraud or makes a costly error, the CPL provides the answer.

This guide will explain what a CPL is, its purpose, its legal standing, and when it is used to protect parties in a real estate closing.

What is an Insured Closing Letter (CPL)?

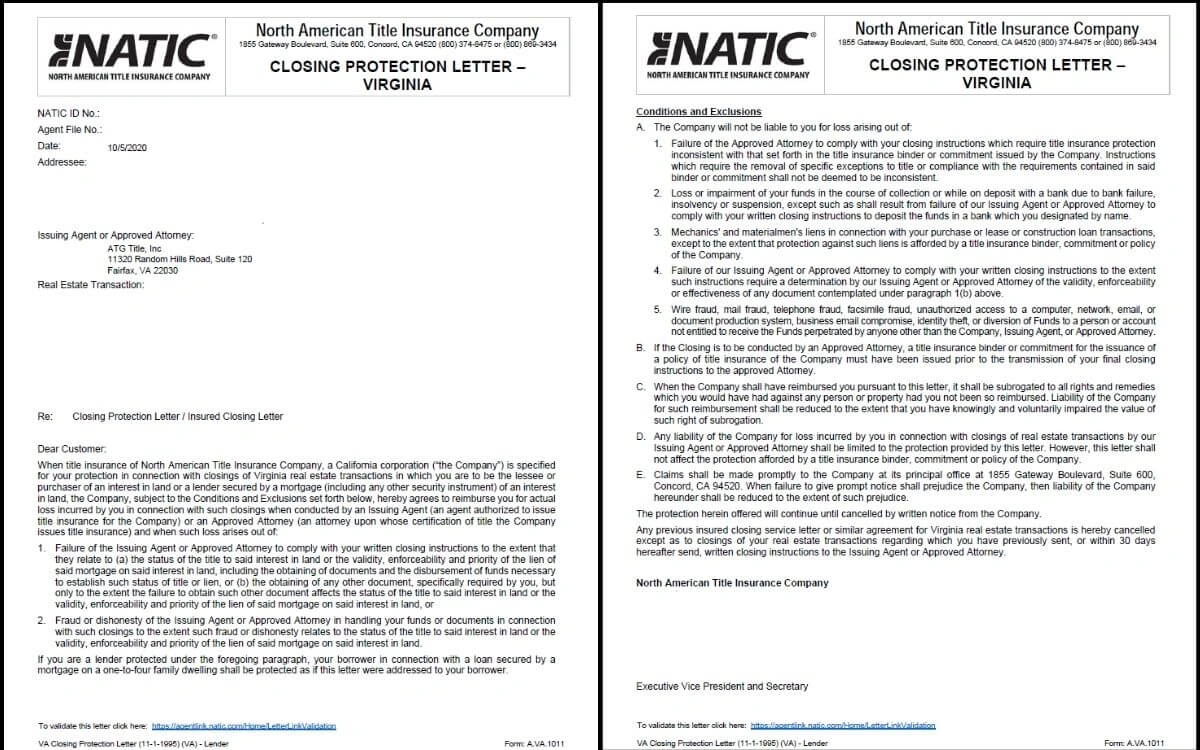

An Insured Closing Letter (CPL) is a contractual agreement issued by a title insurance underwriter. It indemnifies—or financially protects—a real estate lender against actual losses caused by specific misconduct of the closing agent.

Think of it as an insurance policy on the closing process itself. While a title insurance policy protects against defects in the property’s title, the Closing Protection Letter safeguards the funds and documents exchanged during the closing.

Key Takeaway: A CPL is a guarantee from the title insurer that the closing agent will follow the rules.

The Purpose and Coverage of a CPL

The primary purpose of a CPL is to ensure that the closing agent adheres to the lender’s explicit instructions. It acts as a shield against the human and procedural errors that can derail a transaction.

A standard CPL typically covers losses resulting from:

- Failure to Follow Closing Instructions: The agent does not comply with the lender’s written directions.

- Misappropriation of Funds: Theft or fraudulent use of loan proceeds by the closing agent.

- Document Handling Errors: Mistakes in preparing or executing documents that impact the validity or enforceability of the title.

- Fraud or Dishonesty: Any dishonest acts by the closing agent related to the closing.

Who does a CPL protect? While primarily for the lender, most CPLs also extend protection to the borrower in residential transactions (1-4 family dwellings), making them a third-party beneficiary.

Is a CPL Considered Insurance?

This is a crucial legal distinction. Despite its name, an Insured Closing Letter is generally not considered an insurance policy.

Courts have ruled that because no specific premium is charged for the CPL and it doesn’t function to “spread risk” in the traditional insurance sense, it is treated as a warranty letter or a standard contract. This distinction affects how claims are handled and the statutory rights available to the parties.

- Example: In Metmor Financial, Inc. v. Commonwealth Land Title Insurance Company, the Alabama Supreme Court explicitly ruled that CPLs are not insurance contracts.

When is a CPL Used in Real Estate Transactions?

CPLs are a foundational risk management tool in nearly all institutional real estate closings.

- Lender Protection: Under regulations like the Dodd-Frank Act, lenders can be held liable for the actions of the closing agents they hire. A CPL is a non-negotiable requirement for lenders to vet and approve a title company, providing a financial backstop from the underwriter.

- Borrower Protection: For homebuyers, the CPL offers peace of mind, protecting their deposit and loan funds from agent misconduct.

- Escrow Management: The CPL indemnifies against losses if an agent fails to properly disburse funds from the escrow account as instructed.

- Fraud Prevention: This is the first line of defense against theft or misappropriation by a closing agent, with title insurers paying millions in claims related to such fraud.

CPL Liability and Agency Relationships

A critical factor in CPL claims is the relationship between the closing agent and the title insurer.

- Authorized vs. Unauthorized Agents: Title insurers often specify in their agency agreements whether an agent is authorized to conduct closings on their behalf. If an unauthorized agent causes a loss, the insurer may attempt to deny the CPL claim.

- Court Interpretations: Courts typically analyze these situations through the lens of agency law. While insurers may argue a closing agent was acting independently, courts have sometimes held the insurer liable based on the “apparent authority” they granted the agent by issuing the CPL.

Conclusion: An Essential Layer of Security

An Insured Closing Letter is an indispensable component of a secure real estate transaction. It does not replace title insurance but complements it by addressing the specific risks of the closing process. For lenders, it is a mandatory due diligence step. For borrowers, it is a vital, often overlooked layer of financial protection against fraud and error at the closing table.

5 Responses

I dugg some of you post as I cogitated they were very useful handy

Hi there, You’ve performed a great job. I will certainly digg it and individually suggest to my friends. I am sure they’ll be benefited from this site.

I have learn several good stuff here. Certainly worth bookmarking for revisiting. I surprise how a lot attempt you put to create this sort of fantastic informative site.

You are my inhalation, I possess few blogs and sometimes run out from brand :). “No opera plot can be sensible, for people do not sing when they are feeling sensible.” by W. H. Auden.

Really great visual appeal on this site, I’d rate it 10 10.