Looking for honest Tesco travel insurance reviews before your next trip? While Tesco has been selling insurance since the 1990s, its travel protection options might not be as straightforward as they seem.

Despite earning impressive 4-Star and 5-Star Defaqto ratings, we’ve found some concerning gaps in their coverage that could affect your family’s protection. Although prices start from under £30 for a single trip and annual policies from around £70 for a family of three, these attractive rates might hide limitations. Furthermore, Tesco offers Clubcard members a 10% discount on single-trip and backpacker policies, but this benefit comes with restrictions. However, it’s worth noting that Tesco might not cover you if someone in your family has ongoing health issues, which could leave you vulnerable when you need protection most.

In this comprehensive Tesco travel insurance review, we’ll examine whether Tesco Bank travel insurance reviews match the reality of their service. Is Tesco travel insurance any good when you actually need to make a claim? We’ll analyze Tesco travel insurance Trustpilot feedback and investigate Tesco travel insurance claim reviews to uncover the truth behind the marketing.

Tesco Travel Insurance 2025: What’s New and Who It’s For

Tesco offers several travel insurance options in 2025, each tailored to different travel needs and scenarios. I’ve researched their current policies to help you determine if they match your requirements before making a decision.

Policy Types: Single Trip, Annual, Backpacker

Tesco provides three main policy types to accommodate various travel patterns:

- Single Trip – Ideal for occasional travelers planning one vacation. Coverage begins from your departure date and ends when you return home, with protection for trips up to 45 days.

- Annual Multi-Trip – Perfect for frequent travelers making multiple journeys throughout the year. This option covers unlimited trips within 12 months, though each trip is typically limited to 31 days (extensions available).

- Backpacker – Specifically designed for long-term travelers and gap year adventurers. This policy offers extended coverage for continuous travel lasting between 6 and 18 months.

Each policy type is available in three tiers: Economy, Standard, and Premier, offering increasing levels of coverage and corresponding premium increases.

Eligibility Rules and Age Limits

Notably, Tesco’s eligibility requirements vary significantly across policy types. For Single Trip and Annual policies, travelers must be UK residents with a permanent UK address. Additionally, the age limits deserve careful attention:

Single-trip policies generally accommodate travelers up to age 85, making them accessible for senior travelers. In contrast, Annual Multi-Trip policies have stricter age restrictions, typically capping eligibility at 75 years. The Backpacker option is primarily targeted at younger travelers, with maximum age limits around 35-45 years.

Couples and families can opt for joint policies, potentially offering better value than individual coverage. Nonetheless, all travelers listed on a policy must meet the eligibility criteria independently.

Underwriters and Recent Changes

Currently, Tesco’s travel insurance is underwritten by Ageas Insurance Limited, not by Tesco Bank itself. This partnership means your claims are processed by Ageas, though customer service remains primarily through Tesco channels.

For 2025, Tesco has implemented several changes to its policies. Most significantly, they’ve expanded their medical coverage limits on Premier plans and enhanced their digital claims process for faster resolution. Moreover, they’ve adjusted their COVID-19 coverage terms to better reflect current global health situations.

Consequently, if you’re considering Tesco travel insurance, reviewing their latest policy documents is essential, especially if you’ve used their services previously, as terms may have changed.

Coverage Levels Compared: Economy vs Standard vs Premier

When examining Tesco’s travel insurance tiers in depth, the differences between Economy, Standard, and Premier plans become immediately apparent in terms of both coverage and value.

Medical and Dental Coverage Limits

All three Tesco travel insurance tiers offer unlimited emergency medical expenses coverage, providing substantial protection for unexpected health issues abroad. The dental coverage, however, varies significantly – Economy plans provide just £250 for emergency dental treatment, Standard increases to £350, and Premier offers a much more generous £1,000. This difference could be crucial for travelers experiencing serious dental emergencies in countries with expensive healthcare.

Cancellation, Baggage, and Delay Benefits

Initially, the most striking difference appears in the cancellation coverage: Economy provides just £1,000, Standard offers £5,000, while Premier extends to £10,000. Regarding baggage protection, Economy covers up to £1,000 with a £250 limit per item, Standard increases to £2,000 with a £350 item limit, and Premier provides £3,000 with a £500 item limit.

Travel delay compensation also differs substantially across tiers. Economy and Standard both offer £500 for delays, but Premier increases this to £1,000. Likewise, baggage delay compensation rises from £250 on Economy to £500 on Standard and jumps to £1,500 on Premier plans.

Policy Excess and What It Means for You

The policy excess – what you pay toward each claim – represents perhaps the most practical difference between tiers. Economy plans require a substantial £99 excess per person, Standard reduces this to £75, while Premier plans feature no excess whatsoever. Therefore, Premier policyholders receive full compensation for valid claims without deductions.

It’s worth noting that excess is typically applied per person, per incident. For families, this means multiple excesses could apply to a single claim event, potentially reducing your payout substantially. For instance, a family of four claiming for trip cancellation with a £50 standard excess would need to pay £200 (4 × £50) toward the claim.

Hidden Costs and Optional Extras You Might Miss

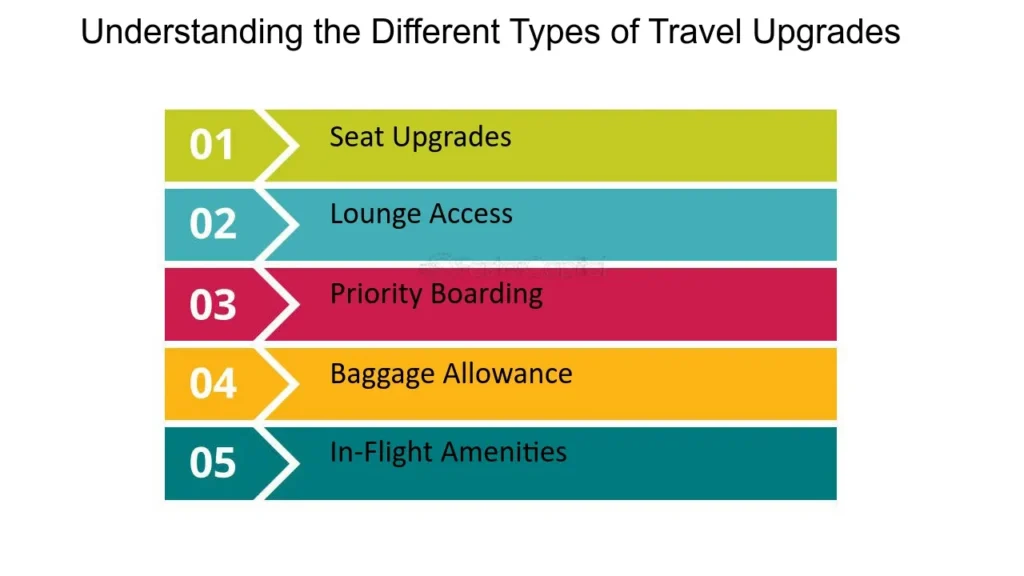

Beyond the base policy costs, Tesco Travel Insurance includes several optional add-ons that increase your premium substantially.

Winter Sports, Cruise, and Gadget Cover Add-ons

Winter sports coverage varies by tier, with Standard plans offering up to £1,000 for ski equipment and £300 for equipment hire. Cruise cover includes cabin confinement compensation (£100 per day up to £1,000), missed port departure protection (£500-£1,500 depending on tier), and shore excursion coverage (£500). Gadget cover protects electronics up to £3,000, yet requires a separate £50 excess per claim.

Collision Damage Waiver and Golf Cover

The Collision Damage Waiver covers rental car excess fees up to £10,000 per claim. Golf coverage is exclusively available on Premier policies or as an add-on, offering £1,000-£3,000 for equipment, depending on the tier.

Clubcard Discount Limitations

Indeed, Clubcard members receive a 10% discount on base policies, yet this advantage doesn’t extend to any add-ons. Hence, the savings diminish considerably once you include necessary extras.

Excess Charges and Upgrade Costs

Each policy tier carries different excess amounts, plus Tesco offers a “double excess option”. This option reduces your premium but doubles what you pay per claim. Economy policies typically exclude most optional extras completely, forcing upgrades to Standard or Premier tiers for comprehensive coverage.

Coverage Gaps That Could Affect Your Claim

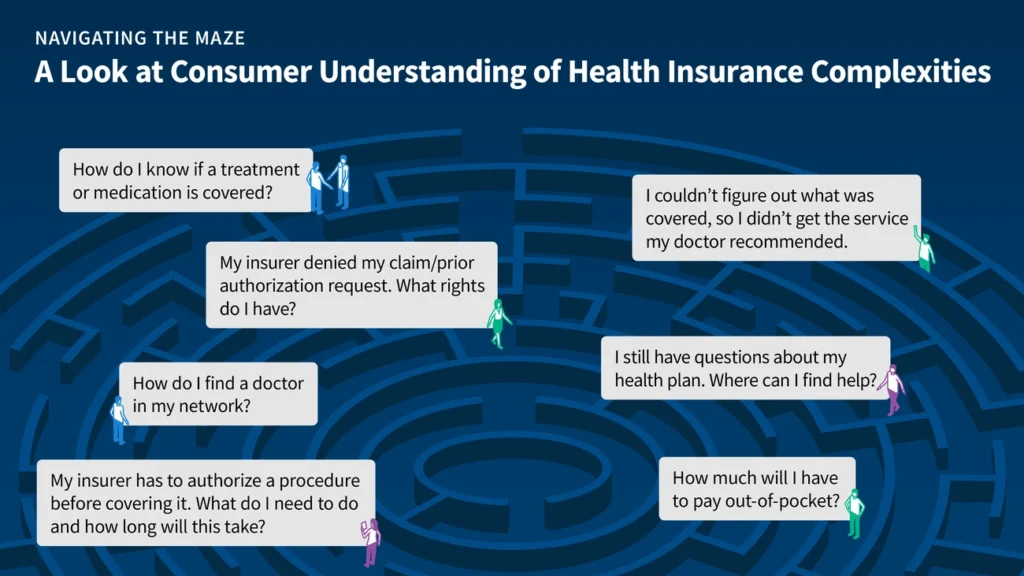

Understanding the fine print in Tesco travel insurance policies is crucial for avoiding claim denials. Their policy contains significant coverage gaps that could leave you financially exposed.

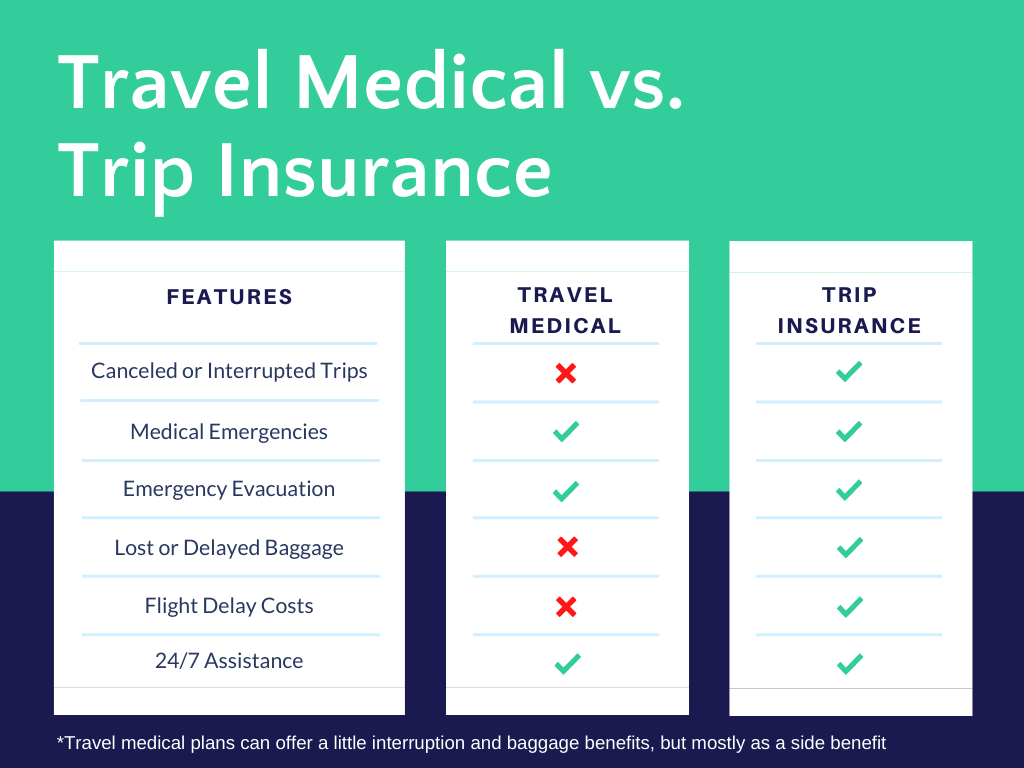

Pre-existing Conditions and Medical Exclusions

Tesco requires disclosure of all pre-existing medical conditions. Unfortunately, even after disclosure, they might not cover certain conditions or may charge additional premiums. Their policy becomes void if you travel against medical advice. Furthermore, if your close relative has a serious medical condition requiring hospital treatment, any claims related to their condition aren’t covered.

Activities and Destinations Not Covered

Walking above 2,500m sea level isn’t covered—effectively excluding many popular sites in Bolivia and Peru. Numerous sports require additional premiums, yet many Trustpilot reviewers report discovering these exclusions too late. Tesco’s policy also explicitly excludes “dangerous activities” unless listed in its approved activities section.

Common Claim Rejections and Why They Happen

According to industry data, approximately 20% of travel insurance claims are rejected. Primary rejection reasons include:

- Cancelations outside the coverage scope

- Undeclared pre-existing conditions

- Inadequate proof for lost items

- Claims below policy excess

Tesco Travel Insurance Trustpilot Complaints

Several Trustpilot reviewers report denied claims due to technicalities. One customer was misinformed about passport coverage. Another discovered pre-booked expenses weren’t covered under the backpacker policy. Many others faced claim denials after several months of waiting.

Conclusion

Tesco travel insurance certainly offers attractive starting rates and decent Defaqto ratings, but a closer examination reveals significant concerns for potential customers. Undoubtedly, the tiered structure provides options for different budgets, though Economy plans feature substantial limitations that might surprise travelers at the worst possible moment. Additionally, the £99 excess on Economy policies could quickly add up for families making multiple claims.

After reviewing the evidence, I find the coverage gaps particularly troubling. The exclusion of pre-existing conditions, even for family members not traveling with you, creates a major vulnerability. Similarly, the altitude restrictions essentially eliminate coverage for popular South American destinations without a clear warning to customers.

While Clubcard discounts appear valuable at first glance, they apply only to base policies and not to essential add-ons. Therefore, the actual savings diminish considerably once you include necessary coverage extensions like winter sports or cruise protection.

Trustpilot reviews paint a concerning picture as well, with numerous customers reporting denied claims based on technicalities or experiencing frustratingly slow processing times. These real-world experiences suggest a disconnect between Tesco’s marketing promises and claims and realities.

Overall, I cannot recommend Tesco travel insurance without serious reservations. Although it might work for travelers with straightforward needs and excellent health, those with any medical history or plans for activities beyond basic tourism should look elsewhere. Before purchasing any Tesco policy, read the exclusions carefully and consider whether the potential savings justify the coverage limitations. Sometimes, paying more upfront for comprehensive protection from another provider might save both money and headaches when you actually need to file a claim.

One Response

Enjoy peace of mind with Nassau Airport Shuttle Transfer, featuring safe Nassau airport shuttle service. From group airport shuttle Nassau Bahamas to private Nassau airport transportation, every shuttle transfer from Nassau airport is smooth and stress-free.