Comprehensive vehicle insurance is a type of automobile coverage that pays for damage to your vehicle caused by incidents other than collisions. This insurance addresses damages resulting from events beyond the driver’s control, such as natural disasters, theft, vandalism, and encounters with animals.

Unlike liability insurance, which most states legally require, comprehensive coverage remains optional for vehicle owners who have paid off their cars. However, lenders typically mandate this coverage for financed or leased vehicles to protect their investment until the loan is repaid.

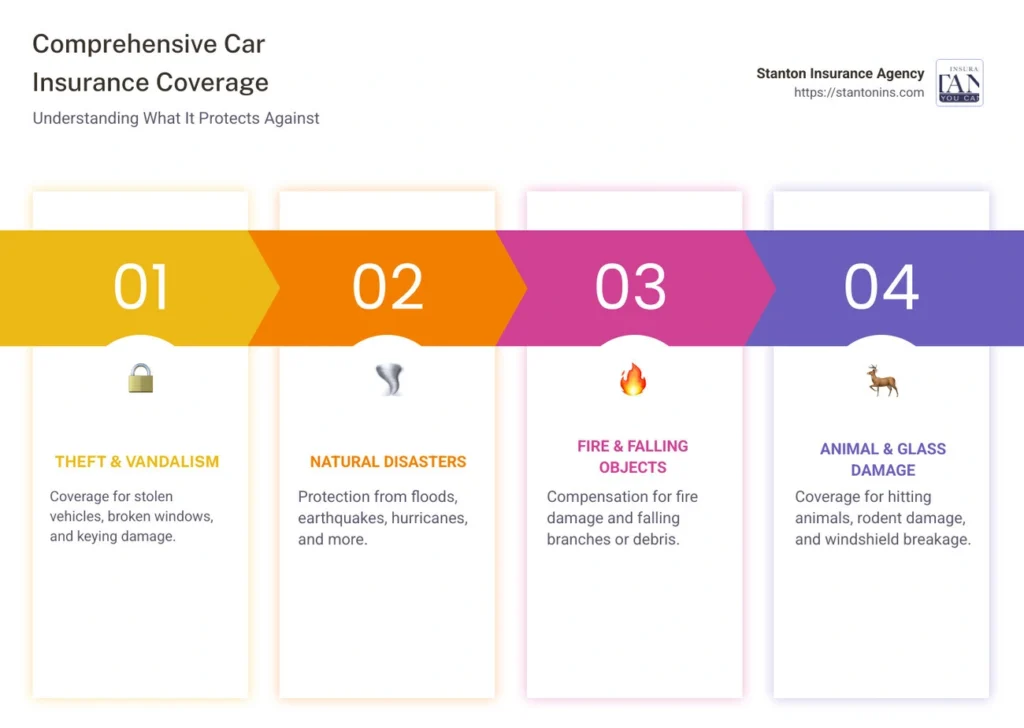

The protection provided by comprehensive insurance extends to numerous situations, including fire damage, falling objects, hail, floods, windshield cracks not caused by collisions, and even damage from civil disturbances. Furthermore, it covers theft of the entire vehicle or specific parts.

When filing a claim under comprehensive coverage, policyholders must first pay their chosen deductible before the insurance company covers the remaining repair costs or the actual cash value of the vehicle if it’s a total loss. The maximum payout for comprehensive claims is based on the current market value of the vehicle, not the original purchase price.

Comprehensive coverage works alongside two other primary components of auto insurance: collision insurance (which covers damage from accidents) and liability insurance (which pays for damage to others’ property or injuries). While sometimes mistakenly called “full coverage,” comprehensive insurance specifically addresses non-collision incidents.

The cost of comprehensive insurance varies based on several factors, including the vehicle’s make and model, selected deductible amount, driving history, and geographic location. Areas prone to severe weather, high theft rates, or frequent wildlife encounters may have higher premiums due to increased risk factors.

Although comprehensive and collision coverages serve different purposes, many drivers choose to carry both for maximum vehicle protection.

What does comprehensive vehicle insurance cover?

Comprehensive vehicle insurance coverage extends to a wide range of non-collision incidents that can damage your vehicle. This protection applies to numerous scenarios beyond your control, addressing damages that might otherwise leave you with substantial repair costs.

Natural disasters and weather events

Comprehensive vehicle coverage safeguards against damage from extreme weather conditions and natural disasters. This includes protection against hurricanes, tornadoes, floods, and earthquakes. During severe storms, your vehicle may sustain damage from high winds or flying debris—all covered under this insurance. Additionally, hailstorms that dent your car’s exterior or crack windshields are typically included. Comprehensive insurance also addresses damage from lightning strikes that might affect your vehicle’s electrical system. Moreover, water damage from flooding, regardless of whether it results from heavy rainfall or storm surges, falls under this protection.

Theft and vandalism

When your vehicle is stolen, comprehensive insurance helps pay for its replacement if not recovered. This coverage extends to break-in damages as well, including broken windows, damaged locks, and ignition systems. For recovered vehicles that sustained damage while stolen, comprehensive insurance covers necessary repairs minus your deductible. Besides full vehicle theft, protection against stolen car parts, particularly catalytic converters, is typically included. Vandalism damage—such as graffiti, broken windows, or other malicious destruction—is covered through comprehensive insurance. This protection also extends to damage resulting from riots or civil disturbances.

Animal collisions

Striking an animal with your vehicle constitutes another situation where comprehensive insurance provides protection. This coverage applies whether you hit wildlife like deer or domestic animals. Comprehensive insurance also addresses damage caused by animals setting up habitats in engine compartments or chewing on wiring. Generally, these claims are not considered your fault; consequently, they may not impact your insurance rates. In regions with substantial wildlife activity, this coverage becomes especially valuable.

Falling objects and fire

Comprehensive coverage protects against damage from objects falling onto your parked vehicle. This encompasses tree branches, rocks dropped from overpasses, or debris dislodged during storms. Similarly, fire damage to your vehicle receives coverage regardless of cause—whether from electrical faults, fuel leaks, or spreading from nearby structures. When a fire originates from a collision with another vehicle, your collision coverage applies instead. Nevertheless, fires resulting from mechanical defects or electrical issues fall under comprehensive protection.

Comprehensive vehicle insurance vs collision insurance

While comprehensive vehicle insurance protects against non-collision incidents, collision insurance covers damage to your vehicle resulting from accidents with other vehicles or objects. These two coverage types serve complementary yet distinct purposes in automobile protection.

Collision insurance pays for repairs when you hit another vehicle, strike an object like a fence or guardrail, experience damage from a rollover, or sustain car damage caused by an uninsured driver. Essentially, it addresses damages from traffic accidents regardless of fault.

Nationwide data from 2020 indicates that drivers paid an average annual collision premium of $370.73, substantially higher than the $174.26 average for comprehensive coverage. This price difference reflects the higher frequency of collision claims compared to comprehensive claims.

Though neither coverage type is mandated by state law, most lenders and leasing companies require both to protect their investment in your vehicle. Accordingly, if you have a car loan or lease, dropping either coverage typically isn’t possible until the vehicle is paid off.

Both coverage types require deductibles—amounts you pay before insurance covers remaining repair costs. Selecting higher deductibles reduces your premium but increases out-of-pocket expenses during claims.

For maximum protection, many drivers carry both coverage types, creating what’s often incorrectly called “full coverage”—a combination of comprehensive, collision, and state-required liability insurance.

Is comprehensive vehicle insurance worth it?

The value of comprehensive vehicle insurance depends on several factors related to your vehicle and personal circumstances. Determining whether this coverage makes financial sense requires evaluating specific scenarios where its benefits often outweigh costs.

When your car is financed or leased

For financed or leased vehicles, comprehensive coverage isn’t merely optional—it’s typically mandatory. Lenders and leasing companies routinely require both comprehensive and collision insurance to protect their investment until the loan is fully repaid. These institutions want assurance that their financial interest remains protected against potential damage from non-collision incidents. Most reputable dealers mandate this coverage since financed vehicles represent debt, creating a higher risk.

If you live in high-risk areas

Geographical location significantly affects the worth of comprehensive vehicle insurance. Individuals residing in regions prone to extreme weather events face increased risks of vehicle damage. Likewise, areas with higher theft rates or substantial wildlife activity make comprehensive coverage particularly valuable. These environmental factors constitute risks beyond driver control yet can cause substantial financial losses without appropriate coverage.

For newer or high-value vehicles

Comprehensive insurance becomes increasingly worthwhile for newer or expensive vehicles. Since this coverage reimburses up to the actual cash value of your car (minus deductible), it provides substantial protection for high-value automobiles. Indeed, when repair or replacement costs would create significant financial hardship, comprehensive coverage offers important protection.

When you want full protection beyond accidents

Ultimately, comprehensive insurance delivers peace of mind against numerous non-collision risks. This coverage ensures drivers won’t face financial burdens arising from unexpected events that could otherwise lead to significant repair costs. Furthermore, comprehensive protection frequently results in lower out-of-pocket expenses during repairs or replacements.