Did you know that fixing a broken leg can cost up to $7,500 without proper mywebinsurance.com health insurance coverage? Even worse, the average three-day hospital stay costs around $30,000. These staggering figures highlight why health insurance isn’t optional—yet approximately 28 million Americans remain uninsured.

For those who do have insurance, many are silently overpaying. In 2020, the average full-price premium for marketplace plans was $575 per month; however, 86% of enrollees received premium subsidies, averaging $491 per month. Additionally, many policyholders face out-of-pocket limits up to $9,450 for individuals and $18,900 for families in 2024. We created this comprehensive guide to help you navigate the complex insurance web portal landscape and ensure you’re not wasting your hard-earned money on unnecessary coverage.

Throughout this article, we’ll examine the telltale signs of overpaying, break down confusing cost structures, and provide practical strategies to reduce your expenses. Our goal at mywebinsurance.com is simple: to help you secure the coverage you need without the premium you don’t. Whether you’re exploring options on mywebhealth.net or searching for information on http://myinsuranceinfo.com, the principles remain the same—paying for what you need, not what you don’t.

Are You Paying Too Much? Common Signs of Overpaying

Have you ever wondered if you’re throwing money away on your health insurance? If so, you’re not alone. About half of all U.S. adults report difficulty affording healthcare costs, with many quietly overpaying for coverage they don’t fully utilize. Let me walk you through four telltale signs you might be paying too much.

You rarely use your insurance, but pay high premiums

If you’re generally healthy and rarely visit the doctor but still pay high monthly premiums, you’re likely overpaying. This is especially common for self-employed individuals and small business owners. When you’re spending hundreds on coverage you barely use, it’s time to reassess your plan on mywebinsurance.com to find better-balanced options.

Your deductible is too high for your needs.

Deductibles have been steadily rising—the average individual deductible in employer-sponsored plans reached $1,735 in 2023, nearly triple the $584 average in 2006. For individual market plans, this figure jumps to about $4,490. If you’re struggling to meet your deductible before insurance kicks in, you’re essentially paying twice: once for premiums and again for out-of-pocket medical expenses.

You’re paying out-of-network fees often.n

When doctors or facilities aren’t contracted with your insurance plan, you could end up paying the full price—often substantially higher than in-network rates. Furthermore, if your doctor’s bill exceeds what your plan covers, you might be responsible for the difference plus your deductible, copay, and coinsurance. Regular out-of-network charges can quickly add thousands to your annual healthcare costs.

You’re not using the included benefits like preventive care.

Surprisingly, preventive care remains underutilized despite being covered at 100% under most plans when you stay in-network. Regular screenings and preventive services can significantly reduce emergency room visits and manage chronic conditions before they worsen. By not taking advantage of these included benefits, you’re effectively overpaying for your insurance.

Using an insurance web portal like mywebhealth.net can help you compare plans and find coverage that matches your actual healthcare usage patterns. In fact, reviewing your plan annually could save you thousands in unnecessary premiums and out-of-pocket costs.

Breaking Down Health Insurance Costs

Understanding your health insurance bill is like deciphering a complex puzzle. Let’s break down the four major components that make up your total costs.

Premiums: What you pay monthly

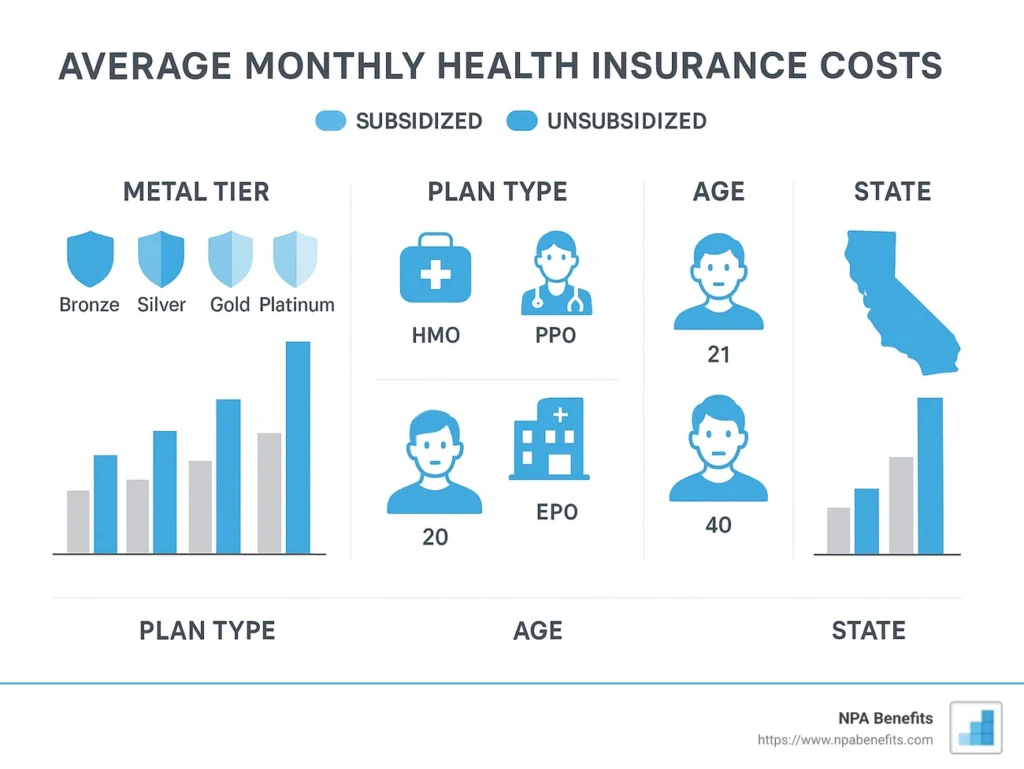

Your premium is the fixed monthly fee you pay to keep your coverage active, regardless of whether you use any healthcare services. Think of it as your insurance subscription. The average full-price premium for Marketplace plans in 2024 was about $603 per month. However, most people don’t pay full price—93% of enrollees received subsidies averaging $536 monthly. For employer-sponsored plans, companies typically cover about 85% of individual premiums and 75% of family coverage costs.

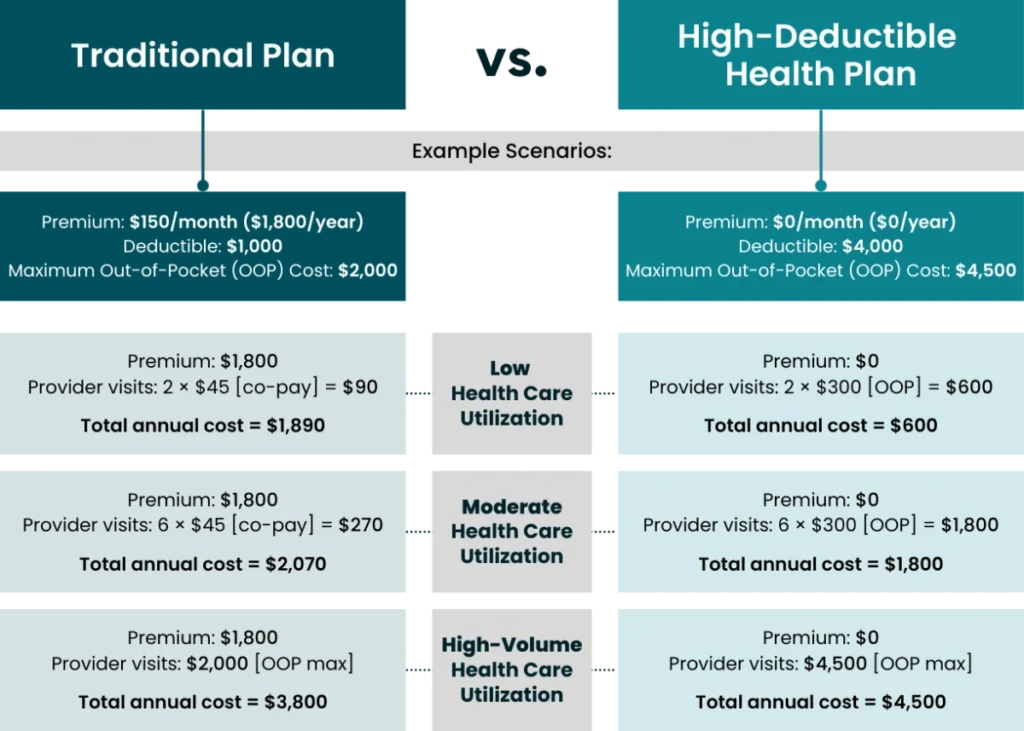

Deductibles: What you pay before coverage starts

A deductible is the amount you pay out-of-pocket for covered services before your insurance begins contributing. With a $2,000 deductible, you’d pay the first $2,000 of eligible expenses yourself. Deductibles reset annually, and higher deductibles typically result in lower monthly premiums. Medical costs like hospitalization, surgeries, lab tests, and non-preventive doctor visits typically count toward your deductible.

Copays and coinsurance: Shared costs after deductible

Once you’ve met your deductible, you’ll share costs through copays or coinsurance. Copays are fixed amounts—like $20 for a doctor visit—paid at the time of service. Coinsurance, meanwhile, is a percentage you pay—commonly 20%—of the covered service cost. For example, with 20% coinsurance on an $8,000 surgery after meeting your deductible, you’d pay $1,600.

Out-of-pocket maximums: Your yearly spending cap

The out-of-pocket maximum is your financial safety net—the most you’ll pay for covered services in a plan year. After reaching this limit, your plan pays 100% of covered costs for the remainder of the year. For 2025 Marketplace plans, these maximums cannot exceed $9,200 for individuals and $18,400 for families. Your deductible, copays, and coinsurance all count toward this maximum, though monthly premiums do not.

Comparing these costs on mywebinsurance.com or mywebhealth.net can help you find a plan that balances your needs and budget more effectively.

How Plan Type Affects What You Pay

The type of health insurance plan you choose directly impacts how much you pay for healthcare. Choosing the right option on mywebinsurance.com could save you thousands annually.

HMO vs PPO vs EPO vs POS: What’s the difference?

Health Maintenance Organizations (HMOs) typically offer lower premiums and require you to select a primary care physician (PCP) who coordinates your care. You’ll need referrals for specialists and must stay in-network except for emergencies.

Preferred Provider Organizations (PPOs) provide greater flexibility—you can see specialists without referrals and use out-of-network providers at higher costs. This freedom comes with higher premiums—averaging $8,906 annually for self-only coverage compared to $8,203 for HMOs.

Exclusive Provider Organizations (EPOs) blend HMO affordability with some PPO flexibility. You won’t need referrals for specialists, but you must stay in-network.

Point of Service (POS) plans combine aspects of both—offering out-of-network coverage with higher copays while requiring PCP referrals.

When a PPO might be costing you more than it should

PPOs cost substantially more—the average monthly premium for a 30-year-old is $512 versus $427 for an HMO. Yet many enrollees rarely use the key benefits justifying this premium: out-of-network coverage and specialist access.

Additionally, PPOs typically impose higher deductibles that must be met before coverage begins. Unless you frequently see specialists or require care outside your network, you’re likely overpaying.

How to check if your plan matches your usage

Evaluate your healthcare needs realistically. If you’re generally healthy with infrequent doctor visits, an HMO or EPO might suffice. Conversely, if you have dependents in different locations or prefer specific out-of-network specialists, a PPO’s flexibility may justify its cost.

Consider how often you see specialists—if rarely, why pay extra for a plan that doesn’t require referrals? Similarly, assess how frequently you use out-of-network providers.

Using MyWebInsurance.com to compare plan types

MyWebInsurance.com simplifies this complex decision by allowing side-by-side comparisons of different health plans. The portal lets you quickly compare premiums, deductibles, and out-of-pocket costs across plan types.

You can also filter results based on priorities like cost or provider networks, ensuring you find coverage that balances your needs and budget. Ultimately, reviewing your plan annually on mywebhealth.net or mywebinsurance.com ensures you’re never paying for flexibility you don’t utilize.

Smart Ways to Lower Your Health Insurance Costs

Looking for ways to slash your health costs without sacrificing quality care? Here are six proven strategies to help you get more value from your health insurance investment.

Use an insurance web portal to compare plans.

Insurance comparison websites like mywebinsurance.com make it easier to find affordable coverage tailored to your needs. These portals allow you to view side-by-side comparisons of premiums, deductibles, and out-of-pocket costs across different plan types. Moreover, you can filter results based on priorities like cost or provider networks, ensuring you find the most cost-effective coverage for your situation.

Switch to a plan that fits your actual needs.

First, evaluate your healthcare usage realistically. If you’re generally healthy with infrequent doctor visits, an HMO or EPO might suffice. Accordingly, during open enrollment, review what services you might need over the coming year, as making this switch can save you thousands annually. Remember that nearly 85% of employees who feel their well-being is supported by their employer intend to remain at their workplace.

Take advantage of preventive care and wellness programs

Most health plans cover eligible preventive care services at 100% as long as they’re provided by in-network doctors. Regular preventive care offers several benefits:

- Early detection of medical problems

- Proactive care and treatment

- Ability to maintain focus on personal health goals

Many employers now offer wellness programs covering various aspects, including physical, emotional, and financial well-being.

Check if your doctors are in-network

To determine if your preferred providers are in-network, search the insurance company’s network database, check the healthcare provider’s website, or contact the insurance company directly. In-network providers have agreed to accept a discounted rate for covered services, consequently saving you substantial money. Out-of-network costs add up quickly—even for routine care.

Use mail-order pharmacies for prescriptions.

Mail-order pharmacies offer a convenient and cost-effective option, particularly for those with chronic conditions requiring regular medication. Benefits include home delivery convenience, cost savings from bulk purchasing, extended 90-day supplies, and improved adherence through auto-refills. Some programs, such as Optum, now offer insulin for just $35 per month for those without insurance.

Review your plan annually on mywebinsurance.com or mywebhealth.net

Provider networks change frequently; as a result, doctors who were in-network last year may be out-of-network this year. During annual enrollment periods, visit mywebinsurance.com to check if your plan still matches your needs. Indeed, monthly premiums for some plans could rise as much as 51% or decrease by up to 14% from year to year!

Conclusion

Health insurance doesn’t have to drain your bank account. Throughout this guide, we’ve seen how millions of Americans quietly overpay for coverage they don’t fully utilize. Certainly, understanding your healthcare needs and matching them with the right plan could save you thousands annually.

Remember those telltale signs of overpaying? High premiums despite rarely using services, struggling with enormous deductibles, facing frequent out-of-network charges, and neglecting included preventive benefits all signal you’re likely spending too much. Additionally, breaking down those complex cost components—premiums, deductibles, copays, and out-of-pocket maximums—gives you the knowledge to make smarter choices.

Plan types matter significantly. The difference between HMOs, PPOs, EPOs, and POS plans goes beyond acronyms—each offers distinct advantages depending on your healthcare patterns. Many people select PPOs for the flexibility they never use, therefore wasting hundreds or thousands yearly on unnecessary features.

Smart strategies can dramatically reduce your costs without sacrificing quality care. Comparing plans on mywebinsurance.com, switching to coverage that actually fits your needs, maximizing preventive care benefits, verifying in-network status for providers, using mail-order pharmacies for prescriptions, and reviewing your plan annually all work together to optimize your healthcare spending.

Your health insurance should provide financial protection without creating financial strain. Armed with the insights from this guide, you can confidently navigate the complex world of health insurance and stop overpaying for coverage. After all, your healthcare dollars should work as hard for you as you worked to earn them.

We encourage you to take action today—review your current plan, assess your actual healthcare needs, and use mywebinsurance.com to find coverage that delivers genuine value. The perfect balance between adequate protection and affordable premiums exists. You just need the right tools to find it.